Automotive Industry Production Data Illustrates Magnitude of Current Supply Chain Crisis

Strong demand for new, large and luxury vehicles comes at a time when automotive production is 20% below its pre-pandemic level. Much of this disconnect between supply and demand is a matter of crippled supply chains and unfortunate events.

For several months now it has been widely reported that supply chains are snarled across the globe. Logistics channels are overwhelmed, leading to delays in the movement of goods both domestically and internationally. Ships filled with goods are spending days harboring nearby, waiting to off-load their cargoes. A lack of empty containers elsewhere means that goods cannot even leave the factory to begin their journey. Added to this are the recent weather challenges in the South-central U.S. which have caused further delays and shutdowns of facilities that produce critical computer chips for the automotive industry.

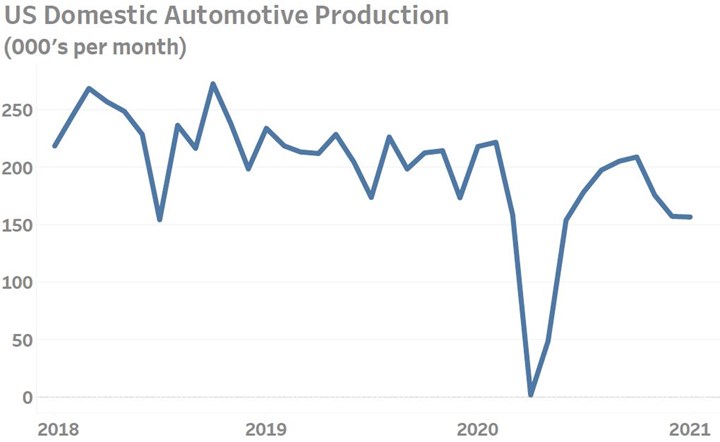

A plant fire on Friday, March 18th, forced the shutdown of a chip making facility located northeast of Tokyo. The shutdown is expected to last at least one month, further restricting the availability of the chips that are desperately needed by the automotive industry. The sum of the auto industry’s challenges become clearly apparent when looking at U.S. Domestic Automotive Production. In the two years leading up to the pandemic, production averaged over 220,000 vehicles monthly. This contrasts with the data collected during the latest two months ending January 2021. In this latest period, production averaged 157,000 per month —down from 196,000 a year ago — representing a 20% decline in unit count production.

U.S. Domestic Automotive Production has fallen 20% in the year ending January 2021. Production has been restrained by disrupted supply chains rather than lackluster demand for new vehicles. Source: Bureau of Economic Analysis as of 3/22/2021.

.jpg;width=70;height=70;mode=crop)